PAN Card Apply Online

Table of Contents

PAN Card Apply Online

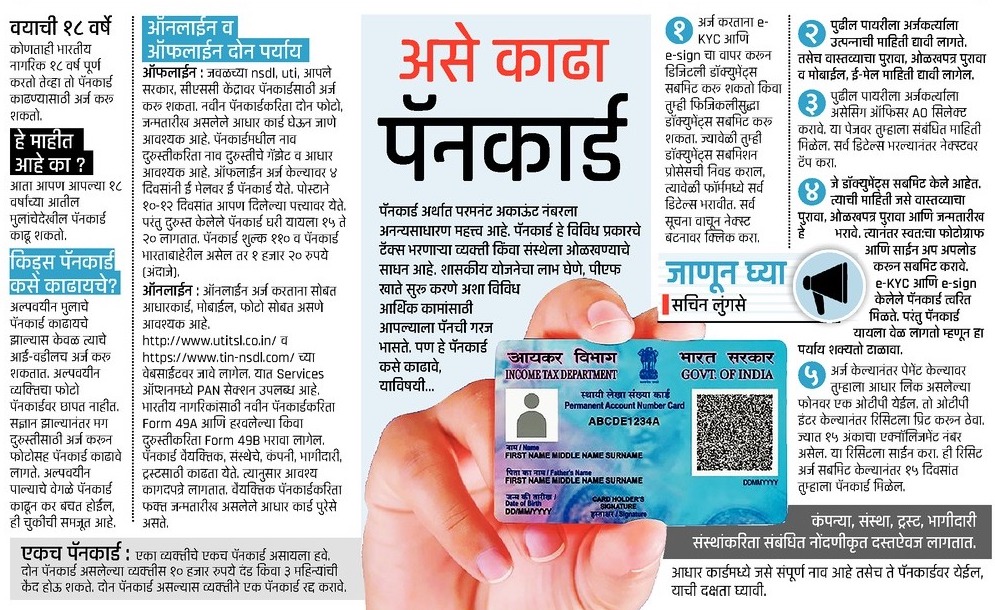

PAN Card Apply Online Complete details of PAN Card and how to apply for it is given in this article. Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated tamper proof card, by the Income Tax Department of India. The Permanent Account Number (PAN) is unique to an individual or entity and it is valid across India. Students can apply for a PAN card as long as they are above 18 years of age. In case you are a minor (younger than 18 years old), your parents can apply for the PAN card on your behalf. There is no maximum age limit for application of PAN card. PAN card is accepted as valid proof of identity anywhere in the country, and is also considered as proof of age. It can also be used as proof of identity when making an application for a passport, voter ID, driving licence, electricity connection etc.

पॅन कार्ड म्हणजे काय ?

(PAN-Permanent Account Number) : पॅन कार्ड म्हणजे आयकर विभागाने आपल्याला दिलेला एक युनिक १० आकडी क्रमांक असतो तो शब्द आणि संख्या मिळून बनलेला असतो. आणि तो भारतात टॅक्स रिलेटेड सर्व इन्फॉर्मशन गोळा करण्या साठी खूप उपयोगी पडतो पॅन कार्डचे पूर्ण रूप आहे

काय फरक आहे पॅन आणि टिन मध्ये ?

- भारतात PAN ला पर्सनल अकाउंट नंबर असे म्हणतात तर भारत बाहेर त्यास TIN म्हणजे टॅक्स आयडेंटिफिकेशन नंबर असे म्हणतात.

- दोन्ही एकच आहे पॅन आणि टिन यामध्ये Confuse होऊ नये, भारताबाहेर तुम्हाला TIN मागतील आणि भारतात तुम्हाला पॅन मागतील.

पॅन कार्डचे संपूर्ण तपशील आणि त्यासाठी अर्ज कसा करायचा?

पॅन कार्ड काय आहे – कायम खाते क्रमांक (PAN) हा दहा-अंकी अल्फान्यूमेरिक क्रमांक आहे, जो भारताच्या आयकर विभागाद्वारे लॅमिनेटेड प्रूफ कार्डच्या स्वरूपात जारी केला जातो. कायमस्वरूपी खाते क्रमांक (PAN) हा एखाद्या व्यक्तीसाठी किंवा संस्थेसाठी अद्वितीय असतो आणि तो संपूर्ण भारतात वैध असतो. 18 वर्षांपेक्षा जास्त वयाचे असल्यास पॅन कार्डसाठी अर्ज करू शकतात. तुम्ही अल्पवयीन असल्यास (18 वर्षांपेक्षा लहान), तुमचे पालक तुमच्या वतीने पॅन कार्डसाठी अर्ज करू शकतात. पॅन कार्ड अर्जासाठी कमाल वयोमर्यादा नाही. देशात कुठेही ओळखीचा वैध पुरावा म्हणून पॅनकार्ड स्वीकारले जाते आणि वयाचा पुरावा म्हणूनही ग्राह्य धरले जाते. पासपोर्ट, मतदार ओळखपत्र, ड्रायव्हिंग लायसन्स, वीज कनेक्शन इत्यादीसाठी अर्ज करताना ओळखीचा पुरावा म्हणून देखील याचा वापर केला जाऊ शकतो.

How to Apply for PAN Card Online

PAN CARD- ONLINE APPLICATION FEES

Application for fresh allotment of PAN can be made through Internet. Further, requests for changes or correction in PAN data or request for reprint of PAN card (for an existing PAN) may also be made through Internet.

- The charges for applying for PAN is Rs. 93 (Excluding Goods and Services tax) for Indian communication address and Rs. 864 (Excluding Goods and Services tax) for foreign communication address.

- Payment of application fee can be made through credit/debit card, demand draft or net-banking.

- Once the application and payment is accepted, the applicant is required to send the supporting documents through courier/post to NSDL/UTITSL. Only after the receipt of the documents, PAN application would be processed by NSDL/UTITSL.

- For New PAN applications, in case of Individual and HUF applicants if Address for Communication is selected as Office, then Proof of Office Address along with Proof of residential address is to be submitted to NSDL w.e.f. applications made on and after 1st November 2009.

- As per RBI guidelines, the entities making e-commerce transactions are required to provide PIN (Personal Identification Number) while executing an online transaction. Therefore, before making payment for online PAN/TAN applications using credit card / debit card / net banking, applicant is required to obtain PIN from Banks whose credit card/debt card/net banking is being used.

Process for New PAN Card

- Click on “Apply Now” tab to fill online Application form for New PAN card.

- Fill in your details to complete the PAN application form online and click on Next Button.

- Make payment. You can easily choose the mode of payment.

- Once the payment is successful, download and print your pre filled application form.

- Click on “Proceed Next” button and refer the “Instruction Manual and Document List” button.

- Paste photo, sign, attach documents and post to our address mentioned in instruction Manual.

- Send the Docs by post/courier

- Get the PAN Card Delivered at Your Door Step

Apply for Reprint of PAN Card

- This application should be used when PAN has already been allotted to the applicant but applicant requires a PAN card. A new PAN card bearing the same PAN details is issued to the applicant.

- (A) PAN applicants can now apply online for Reprint of PAN card (only when there is no change required in data) by clicking here. This facility is only available for those PAN holders whose latest PAN application was processed through NSDL e-Gov and / or e-Filing portal of Income Tax Department. Option for update of PAN details will not be available through this facility.

- (B) If the communication address of an applicant as per latest records available with NSDL e-Gov is an Indian address, then applicant needs to make an online fee payment of ₹50 (inclusive of taxes) and if it is a foreign address, then payment of ₹959 (inclusive of taxes) has to be made by the applicant.

- (C) There is no requirement of submitting any application form along with supporting documents for processing this PAN card reprint request. Kindly click on guidelines to know more.

- Alternatively, an applicant can apply for a reprinted PAN card through normal online PAN application mode whose details are given below.

-

- (A) While filling this form, applicant should not select any of the check boxes on the left margin of the form. However, the check box for Item no. 7 Address for communication will be selected by default as this address will be updated in the records of ITD.

पॅन कार्ड रीप्रिंट कसे करायचे येथे पहा…!

How to Download PAN Card Online?

You can download PAN card soft copy (e-PAN card) through the NSDL portal with your Acknowledgement number as well as your PAN and date of birth.

Here are the steps by which you can download your e-PAN card with the acknowledgement number:

- Visit the NSDL portal to download the e-PAN with acknowledgement number.

- Enter the acknowledgement number which you have received.

- Click on Generate OTP.

- Enter the OTP you have received on your mobile and click on ‘validate’.

- Click on the ‘download PDF’ option to download the e-PAN instantly.

e-PAN Card Download from NSDL

- The facility to download e-PAN through the NSDL portal is available for applicants who have applied through the NSDL website.

- Any new PAN application or any application for changes can be downloaded free of cost if applied before 30 days of confirmation from the income tax department.

- Otherwise, extra charges are payable.

Required documents for PAN Card

- Individual applicants should provide proof of residential address.

- If the applicant is a minor (i.e. below 18 years of age at the time of application), any of the documents as per the lists specified below of any of the parents/ guardian of such minor shall be deemed to be the proof of identity and address of the applicant.

Indian Citizens (including those located outside India)

| Proof of Identity | Proof of Address | Proof of date of birth |

|---|---|---|

| (i) Copy of any of the following documents bearing name of the applicant as mentioned in the application:- | (i) Copy of any of the following documents bearing the address mentioned in the application:- | Copy of any of the following documents bearing the name, date, month and year of birth of the applicant as mentioned in the application:- |

| a. Aadhaar Card issued by the Unique Identification Authority of India; or | a. Aadhaar Card issued by the Unique Identification Authority of India; or | a. Aadhaar card issued by the Unique Identification Authority of India;or |

| b. Elector’s photo identity card; or | b. Elector’s photo identity card; or | b. Elector’s photo identity card; or |

| c. Driving License; or | c. Driving License; or | c. Driving License; or |

| d. Passport | d. Passport | d. Passport |

| e. Ration card having photograph of the applicant; or | e. Passport of the spouse; or | e. Matriculation certificate or Mark sheet of recognized board; or |

| f. Arm’s license; or | f. Post office passbook having address of the applicant; or | f. Birth certificate issued by the municipal authority or any office authorised to issue birth and death certificate by the Registrar of Birth and Deaths or the Indian Consulate as defined in clause (d) of sub-section (1) of section 2 of the Citizenship Act, 1955 (57 of 1955); or |

| g. Photo identity card issued by the Central Government or State Government or Public Sector Undertaking; or | g. Latest property tax assessment order; or | g. Photo identity card issued by the Central Government or State Government or Central Public Sector Undertaking or State Public Sector Undertaking; or |

| h. Pensioner card having photograph of the applicant; or | h. Domicile certificate issued by the Government; or | h. Domicile certificate issued by the Government; or |

| i. Central Government Health Scheme Card or Ex-Servicemen Contributory Health Scheme photo card | i. Allotment letter of accommodation issued by the Central Government or State Government of not more than three years old; or | i. Central Government Health Service Scheme photo card or Ex-servicemen Contributory Health Scheme photo card; or |

| j. Property Registration Document; or | j. Pension payment order; or | |

| (ii) Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer | (ii) Copy of following documents of not more than three months old (a) Electricity Bill; or (b) Landline Telephone or Broadband connection bill; or (c) Water Bill; or (d) Consumer gas connection card or book or piped gas bill; or (e) Bank account statement or as per Note 2 ; or (f) Depository account statement; or (g) Credit card statement; or |

k. Marriage certificate issued by the Registrar of Marriages; or l. Affidavit sworn before a magistrate stating the date of birth. |

| (iii) Bank certificate in Original on letter head from the branch(alongwith name and stamp of the issuing officer) containing duly attested photograph and bank account number of the applicant | (iii) Certificate of address signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer | |

| (iv) Employer certificate in original | ||

| Note: | Note: | |

| 1. In case of Minor, any of the above mentioned documents as proof of identity and address of any of parents/guardians of such minor shall be deemed to be the proof of identity and address for the minor applicant. | 1. Proof of Address is required for residence address mentioned in item no. 7. | |

| 2. For HUF, an affidavit made by the Karta of Hindu Undivided Family stating name, father’s name and address of all the coparceners on the date of application and copy of any of the above documents in the name of Karta of HUF is required is required as proof of identity, address and date of birth. | 2. In case of an Indian citizen residing outside India, copy of Bank Account Statement in country of residence or copy of Non-resident External (NRE) bank account statements (not more than three months old) shall be the proof of address. |

For Categories other than Individuals & HUF i.e. Firm, BOI, AOP, AOP (Trust), Local Authority, Company, Limited Liability Partnership,Artificial Juridical Person

List of documents which are acceptable as proof of identity and address for applicants other than individual and HUF is as below:

1.Having office of their own in India:

| Type of Applicant | Document to be submitted |

|---|---|

| Company | Copy of certificate of registration issued by Registrar of Companies. |

| Partnership Firm | Copy of certificate of registration issued by Registrar of firms or Copy of Partnership Deed. |

| Limited Liability Partnership | Copy of Certificate of Registration issued by the Registrar of LLPs |

| Association of Persons (Trust) | Copy of trust deed or copy of certificate of registration number issued by Charity Commissioner. |

| Association of Person, Body of Individuals, Local Authority, or Artificial Juridical Person | Copy of Agreement or copy of certificate of registration number issued by charity commissioner or registrar of cooperative society or any other competent authority or any other document originating from any Central or State Government Department establishing identity and address of such person. |

2. Having no office of their own in India:

| Type of Applicant | Document to be submitted |

|---|---|

| Company/Firms/Limited Liability Partnership/AOP (Trusts)/AOP/ BOI/Local Authority/Artificial Juridical Person | (1.1) Copy of Certificate of Registration issued in the country where the applicant is located, duly attested by “Apostille” (in respect of the countries which are signatories to the Hague Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the country where the applicant is located or authorised officials of overseas branches of Scheduled Banks registered in India. (1.2) Copy of registration certificate issued in India or of approval granted to set up office in India by Indian Authorities. |

Supporting document required for changes in PAN data

| Case/Applicant type | Document acceptable for change of name/father’s name | |

|---|---|---|

| Married ladies – change of name on account of marriage |

|

|

| Individual applicants other than married ladies |

|

|

| Companies |

|

|

| Firms / Limited Liability Partnerships |

|

|

| AOP/ Trust/ BOI/ AJP/ LOCAL authority |

|

Reprint or Duplicate PAN card

- Most of the time, Indians apply for a duplicate PAN card in the case of loss of the card. In other cases, the card might get stolen, damaged or misplaced. There is a tedious process to apply for a duplicate PAN card which requires filing an FIR.

- Once you file the FIR, a request must be raised by the applicant for the reprint of the card by providing the old PAN and a copy of the FIR. However, due to the time taken for this procedure, most people opt to re-apply for a new PAN Card.

Download Duplicate PAN Card using Aadhaar Card

The NSDL offers you the option to download a duplicate PAN card using your Aadhaar card. You can follow the steps mentioned below to request for your duplicate PAN card using your Aadhaar Card:

- Visit the official TIN-NSDL website of the Income Tax Department at https://www.onlineservices.nsdl.com/paam/ReprintEPan.html.

- Fill in the form with the required data such as your PAN, Aadhaar number, date of birth, and GSTIN (optional).

- Check the box against the ‘Terms and conditions’ declaration.

- Enter the Captcha code in the designated field.

- Click on the ‘Submit’ button to proceed.

- You will be redirected to a new web page wherein you can scroll down and select the option to receive a One Time Password or OTP on your registered contact details (email ID and mobile phone number).

- Generate the OTP and enter the same in the designated field.

- Click on the ‘Validate’ button to submit your request for the issuance of the duplicate Aadhaar card.

अन्य महत्वाच्या योजना !!

नवीन योजना |

सरकारी योजना |

कृषी योजना |

प्रधानमंत्री योजना |

महाराष्ट्र योजना |

दिव्यांग योजना |

Hi

माझ pancard हरवले आहे तर काय करायचे

माझे पान कार्ड हरवले आहे ते परत कसे मिळवायचे

PAN Card Apply Online